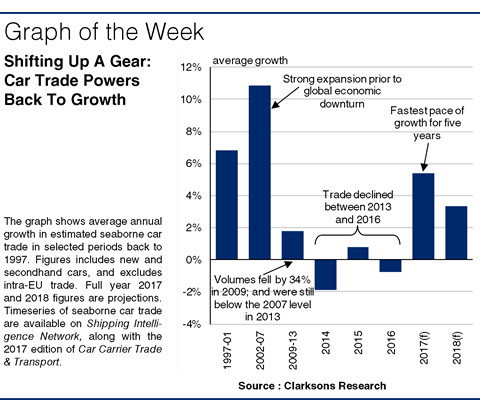

The car carrier sector has experienced very challenging market conditions over recent years, partly reflecting an estimated 2% decline in global seaborne car trade between 2013 and 2016. However, in common with a number of other shipping sectors, 2017 so far has seen an encouraging return to notably more positive trends on the demand side.

The car carrier sector was probably one of the hardest hit by the global economic downturn, with seaborne car trade declining by more than 30% in 2009. Unlike in most other shipping sectors, where demand bounced back fairly quickly, it has taken ten years for seaborne car trade volumes to return to pre-downturn levels, with trade only expected to exceed the 2007 peak this year. The recovery from the downturn has partly been hampered by disappointing volume growth since 2013; seaborne car trade fell by 2% in 2014, and declined again last year to reach an estimated 20.4m cars. The car carrier sector has been highly exposed to sluggish growth in the world economy in recent years, and the impact from the lower commodity price environment on consumer demand in key developing regions last year was especially pronounced. Trends towards relocation of car production to regions closer to major importers have also been unhelpful.

However, some improvement in commodity prices this year, combined with a broad pick-up in global economic growth, has supported a return to faster expansion in seaborne car trade so far in 2017, outperforming initial expectations. Volumes are currently projected to have grown by around 5% in full year 2017 to total 21.5m cars, representing the fastest pace of growth since 2012. Seaborne imports into North America and Europe are expected to have increased by a robust 5% and 10% respectively, whilst exports from key producers Japan and South Korea are projected to have grown by around 3-4%. Imports into key developing regions also appear to have stabilized somewhat after sharp falls in 2016.

Meanwhile, difficult car carrier market conditions in recent years have led to key developments on the supply side. 2016 and 2017 will go down as two of the four highest years for car carrier recycling on record, whilst contracting has slowed to a trickle, with just five ships ordered since start 2016. Alongside slow fleet growth, more positive demand trends finally supported limited improvements in the charter market in the final quarter of 2017.

So, demand growth in the car carrier sector appears to have finally moved back into a more positive phase. Trends in the world economy appear supportive, whilst rapid uptake of electric cars could also provide some upside going forwards. Risks on the demand side remain, and market conditions are still under clear pressure, but this year has at least seen some more positive indications.

(Source : Clarkson)